Chasing Crypto Whales

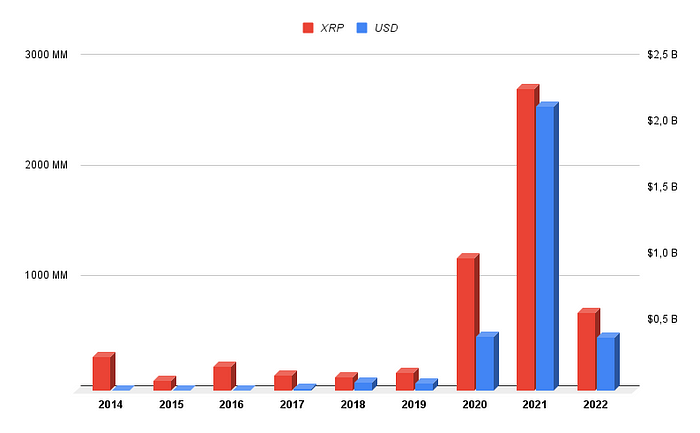

Updated 17/07/2022: Jed McCaleb is almost done with selling his XRP on the market. In total we have been able to track the sales of 5.7 billion XRP for a mind blowing 3.1 Billion USD (at an average price of 0.55 USD per token) over the course of 8 years. The big question that remains now is: what will the XRP price do without the downward pressure generated by Jed’s sales? Stay tuned for the results when we revisit this topic somewhere next year.

Whale Alert is in the crypto whale business. We monitor and analyze blockchains and through Twitter and Telegram we report interesting transactions. We believe transparency is essential for blockchain adoption and that is why we have decided to share some of our knowledge through a series of short articles.

So what are whales? In general we consider a whale as someone who controls enough of a certain asset to be able to influence the price in a meaningful way. There are two types of whales: natural and artificial. A “natural” whale acquired assets on the market while artificial whales received their assets for free, either upon creation (pre-mine) of the asset or through other means. The Winklevoss twins are natural whales, having bought most of their Bitcoins in 2013, long after Bitcoin was created. There are artificial whales on almost every blockchain, but for this article we will take a closer look at one of the most famous ones: Ripple founder and former CTO Jed McCaleb.

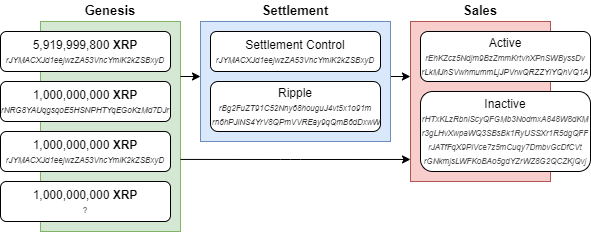

In September 2019 we reported a transfer of 100 million XRP from Ripple to McCaleb’s wallet. This transfer was part of a settlement agreement between him and Ripple which established how much of his assets he would be able to sell. McCaleb’s assets are part of his compensation for his role as a founder of Ripple; he claims to have received 9 billion XRP tokens spread over several addresses at the start of the Ripple ledger. We were able to attribute genesis and other addresses to McCaleb by combining posts made from his blog, XRP Talk and Ripple’s forum (all three have since been taken offline) and information available on the public ledger. By analyzing over 90,000 transactions we were able to track around 8 billion XRP to Ripple, a settlement account and his personal accounts from which he actively sells.

In total we managed to track the sales of 1.05 billion XRP (almost exclusively through Bitstamp) between 2014 and 2019. At an average sale price of 0.129 cents per XRP, the total sale amount was $135 million USD. Additionally, a significant portion of his assets were sent to Ripple for unknown reasons and at least 140 million XRP have been donated to various charities. He continues to sell and during January 2020 has sold another 19 million XRP. At present we estimate McCaleb’s remaining assets at 4.7 billion XRP (around 5% of total existing XRP) carrying a current market value of over $1 billion USD (When he first announced his intent to sell in May 2014, McCaleb’s holdings were worth around $45 million USD). At the current rate it would take him around 20 years to sell all of it, however his activities have been limited by the settlement agreement with Ripple, which is likely to expire sometime in 2020.

But does McCaleb affect the price of XRP? Compared to the total trade volume per day, the amount he is selling seems insignificant. For instance, from the 1st to the 7th of June 2017, he sold a total of 2.5 million XRP for $741,000 USD. The total trade volume that week for the XRP/USD pair on Bitstamp alone was 127 million XRP, but volume is not a good indicator for how much the market can absorb. One of the traders who unknowingly bought XRP from McCaleb had a trading volume of 705,000 XRP that same week on various exchanges (355,000 sold, 350,000 bought); his total assets only had a net change of -5,000 XRP. It’s likely that a very significant part (if not most) of the volume on exchanges comes from comparable traders and that the net change of XRP on the market is much lower. The real question is how much effect McCaleb has on the net amount of XRP available. Even though we do not yet have enough data to make a conclusive statement on this, we can determine that, because he is exclusively selling XRP, he is adding to the net amount available. It is also important to note that it seems that the profits are being cashed out directly through Bitstamp and we found no evidence that any of it is being reinvested into the crypto market.

The lack of privacy on the ledger might seem alarming, but the transparency of blockchains is actually part of what makes them so revolutionary. In traditional markets there is a lot of information asymmetry; for normal participants it is almost impossible to know who owns what or what their intentions are, which puts them at a big disadvantage compared to informed professionals. With blockchain we can tell exactly and with relative ease where every coin/token is and in some cases even infer what the owner intends to do with. This transparency opens up a lot of possibilities, but most importantly it can help create stability and reduce manipulation, something that blockchain has been rife with. Whether or not you believe the future is bright for blockchains like Ripple, the economic power and consequences of whales like Jed McCaleb cannot be ignored and he is not the only one; co-founder Arthur Britto also holds billions of XRP in escrow that will expire sometime in the future.

Disclaimer: This article is for informational purposes only and you should not construe any such information as investment or other advice. Whale Alert and its employees do not engage in any trading activities. We urge everyone to do their own research and draw their own conclusions. None of the information in this article has been directly confirmed by Ripple or Jed McCaleb.